When you’re injured in a car accident, there are likely numerous things on your mind: Submitting a police report, seeking medical treatment, and filing a claim against the person liable for the accident. But what about your car?

Many people assume they will simply get the money they need from insurance to pay for the damage their vehicle sustained, but this is not necessarily true. If the damage to your car will cost more than what the vehicle is actually worth, then it might not be worth it to pay to have it fixed. Furthermore, insurance might not even give you the money to get it fixed in this case. Instead, they might consider your vehicle a “total loss.”

As such, it’s important to understand how insurance claims and car damage works to ensure you make the most of your situation and take the right steps.

If you’ve ever asked, “How do I know if my car is totaled?” we’ve got the answers you need. If you have further questions after reading this article and need help filing a claim to recover compensation for your losses after an accident, our team of Kentucky car accident lawyers at McCoy & Sparks can help.

Is My Car Totaled?

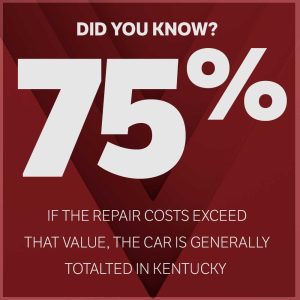

In Kentucky, a car is generally considered totaled if the cost of repairs is more than 75% of the actual value of the car. For example, if the car is worth $15,000 and the repairs will cost more than $11,250 (which is 75% of 15,000), then your car will most likely be considered a total loss.

Of course, most drivers don’t automatically know the actual value of their car, which in legal and insurance terms is the actual cash value (ACV). So it’s helpful to learn how to find your vehicle’s ACV so you will know if it is totaled after an accident.

To learn your vehicle’s ACV, you must first understand that many factors can depreciate a car’s value. Simply driving a new car off the lot where it was purchased depreciates its value. Additional factors such as mileage, the condition of the car, and any previous damage and repairs the car has seen will also play a role in the ACV.

These factors can be confusing for some, as it means your car could appear to be in great condition, but the ACV could still be very low. For example, if your car is only a couple of years old and in great condition because you have kept up with maintenance, it could still be worth significantly less than what you paid for it if you were in an accident and had to have repairs done. Even if you cannot tell that the vehicle had repairs, this information will still show up in the vehicle history and will thus affect the ACV.

It is Kelley Blue Book, or the open market, that determines the ACV of your car. And this value will not be the same as what you paid or the loan amount that you still owe on the car. Kelley Blue Book works by analyzing collected data and historical trends and reports — and every car has a history report.

Thus, if you want to know the ACV of your vehicle, you will need to check Kelley Blue Book.

When is a Car Considered Totaled By Insurance?

When you are involved in an accident and file a claim for compensation to cover car repairs, the insurance company will first conduct an inspection of your vehicle. This is typically done by having a claims adjuster sent to inspect the car and assess the damage.

If the adjuster concludes that the repair cost is more than the vehicle’s ACV, then they will declare your vehicle a total loss. Even if you paid significantly more for the car and even if you still owe a large amount on the loan, the law states that insurance companies are only obligated to pay based on the ACV.

Each state, however, is different. Some states will use a total loss threshold (TLT) vs. simply calling a car a total loss if the repair costs are more than the ACV. As mentioned previously, the TLT for Kentucky is 75%.

If the cost of repairs is less than 75% of the cash value, then insurance will likely cover the cost. If the repairs cost more than 75%, then insurance will consider the vehicle a total loss, and they will not cover the cost.

What Happens If My Car is a “Total Loss?”

If the insurance company declares your vehicle a total loss, they will pay you the ACV. You can then use that money as you wish, such as investing in buying another vehicle. It’s up to you. As for what happens to your totaled car, insurance will usually take it and then notify the DMV that the car is totaled. From there, the vehicle will likely be declared “salvage,” and certain people who specialize in salvaging vehicles can purchase it from the insurance company.

If you want to keep your totaled car, you can negotiate this with your insurance company. However, if you do so, the money you get will be less than the ACV. Specifically, it will be the ACV minus the vehicle’s salvage value.

Of course, this can seem unfair, especially if you feel you are owed more of that the insurance company is going to end up making more money off the car by totaling it and selling it for salvage. Thus, if you disagree with the vehicle being declared a total loss or if you think the insurance company might be ripping you off and paying you less than you deserve, you can bring the case to a lawyer.

Trust McCoy & Sparks—Premier Personal Injury Attorneys in Central Kentucky

At McCoy & Sparks, we understand how frustrating it can be to deal with insurance companies after an accident. Not only are you potentially suffering from injuries, but you might also be facing the loss of your car.

If you need help filing your claim and fighting against the insurance company to get the fair compensation you deserve, our team can help. Recognized as one of Central Kentucky’s best law firms for over a decade, we have helped thousands of clients in Central Kentucky win their cases.

You owe us nothing unless we recover compensation for you. Make the right call to (844) 4KY-WINS for a risk-free consultation with one of our attorneys today.